Despite pleas, SAD 61 settles on $26.1M budget

By Wayne E. Rivet

Staff Writer

NAPLES — In a tight economy, people make tough choices.

Is it a need or a want?

Or, can it wait until times get better?

[stextbox id="info" float="true" align="right" width="150"]

Budget Timeline

• April 4, finalize budget

• May 17, 6 p.m., Lake Region High School, public hearing to discuss moving $250,000 from the Capital Reserve Account to pay for PCBs removal at the high school/vocational center.

• May 17, 6:30 p.m., Lake Region High School, district budget meeting.

• May 24, budget validation referendum vote in the four district towns. One ballot question will ask voters to approve the budget acted upon at the May 17 district meeting. A second question will address whether to use Capital Reserve funds to remove PCBs at the high school/vocational center.

[/stextbox]

SAD 61 Superintendent of Schools Patrick Phillips knows many taxpayers are pushed to the limit trying to make ends meet. As in past years, he instructed his leadership team to propose budgets that were in the best interest of students, yet respectful of what taxpayers can afford.

If an administrator sought to add a new program, he or she had to make cuts elsewhere — a process of addition by deletion. A few examples:

In: Elementary-level reading coaches, $70,000, to help K-2 children become more fluent readers.

Out: Pre-K program, $150,000.

In: A new transition program (8th Grade Summit) to help non-proficient students at Lake Region Middle School improve their skills so they can succeed at the high school level, $45,000.

Out: Due to decreasing enrollment at the high school, 7.5 positions were eliminated, as well as in-school suspension supervisors at LRHS and LRMS.

In: Two Lake Region Vocational Center new course offerings — law enforcement ($31,000) and co-op ($35,000).

Out: LRVC School to Work program, $58,000.

Phillips and his leadership team also had to make some cuts because SAD 61 is staring at a loss of $359,439 in state aid — knocking the local school system

to “minimum receiver†status (allocated state funds solely for special education costs) at $834,133 — while assuming $705,554 in new debt service, as the result of the high school/vocational center project and construction of a new bus garage/maintenance/instructional building. And, there is an anticipated $200,000 hike for health insurance (the final figure is expected in early April).

After school board directors cut $400,000 from the proposed budget (by a slim 6-5 margin — others supported a deeper cut of $700,000), Phillips proposed a general fund budget of $26,121,000 — an estimated 3.59% increase over last year ($25,216,486).

Finance Coordinator Sherrie Small pointed out that the six-year average general fund increase is 0.84%.

Meanwhile, SAD 61 has been battered over the past six years by a major state aid reduction storm. Over this period, SAD 61 has lost $5,838,498 in state aid, mainly because of the area’s “rich†property values. If there is any good news, SAD 61 now knows exactly what number to plug in for state aid, rather than be surprised by nearly $1 million reductions.

While Phillips and some SAD 61 directors feel the proposed $26 million budget is both “responsible†and addresses the educational needs of children, others wonder if more cuts could be made to ease taxpayers’ burden.

During Monday night’s public hearing at Songo Locks School in Naples, two municipal leaders thanked the school board for their hard work, but pleaded with them to dig deeper for cuts.

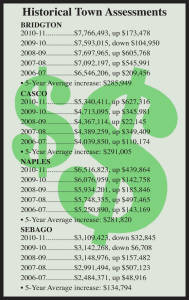

Casco will be hit the hardest — a 13.28% increase, $709,404. Town Manager David Morton said the increase is: greater than the town’s administrative budget; greater than the town’s debt service; greater than the town’s public works and maintenance budget; and greater than the town’s sanitary/solid waste line.

“The impact of this tax will be substantial,†Morton said. Having already reduced all “that we can on the municipal side,†Morton said the school tax increase will be shouldered by taxpayers. The end result: a possible $1.75 increase in the tax rate.

Sebago is looking at a 4.65% hike or $144,716 in local tax dollars. Selectman Allen Crabtree informed the school board that town officials diligently whittled away at their budget, foregoing pay raises and postponing some maintenance projects.

“We’re under flat — $4,000 less than last year. We were very sensitive to people who are suffering as they try to pay their bills,†he said.

Crabtree said he was “ecstatic†when he heard that the SAD 61 Finance Committee was looking to cut $1.1 million from the school budget. He was “hopeful†when the board considered a $700,000 reduction. Crabtree was “disappointed†when directors settled on a $400,000 cut.

Crabtree asked directors to reconsider their approach and take a look at a $700,000 cut.

“We’re trying everything we can on the municipal side to keep the budget down,†he said. “The SAD 61 800-pound gorilla is hard to face.â€

Bridgton is slated for a 3.92% tax increase, $304,585, while Naples is up for a 6.72% hike, $438,127.

While many factors could change Bridgton’s tax rate for the coming year, Town Manager Mitch Berkowitz is starting to see a final figure emerge. At the moment, Bridgton’s rate is $12.20 per thousand. If selectmen apply $128,000 of surplus to reduce taxes, and if voters decide to drop local emergency dispatch in favor of county services for a savings of another $128,000, the 2010-11 school tax would push the local tax rate to $13.03. However, without the surplus and if voters keep dispatching local, the school tax would likely push Bridgton’s tax rate to $13.28.

Berkowitz cited “slow growth,†loss of some state and town revenue and additional energy costs (the manager added $30,000 to the budget to cover projected hikes in fuel expenses) as adverse factors affecting the municipal budget.

How could SAD 61 reach the overall $700,000 reduction target? Directors did discuss these scenarios:

• Larger class sizes for grades K-5. If the district pushed the size of classes from the existing 18-21 to 25, reduction in staff would result in an estimated $300,000 savings.

Historically, SAD 61 school boards have always balked at this option, feeling it is in the best educational interest of students to keep class sizes within 18 to 21.

• Directors tried to cut $100,000 by reducing the number of creative fine arts staff at the middle school, but ultimately restored full funding.

• Money could be saved by altering the high school/vocational center project. Casco Manager David Morton suggested Monday night to pull funds aimed at addressing PCBs removal (levels were found from caulking used around exterior windows and doors) to reduce the budget.

So, what part of the plan could be scaled back? Two pieces considered included elimination of the dance room ($271,405) or the music room addition/renovation ($178,245).

School officials argue SAD 61 should keep the project intact, as presented and voted upon by area taxpayers.

After lengthy discussion, directors again narrowly approved (6-4) the proposed $26,121,000 budget.

Next, it’s taxpayers’ turn.