Towns banding together to save revenue sharing

Staff Writer

They didn’t know what kind of turnout to expect, but Bridgton Selectmen were well-pleased when officials from area towns showed up to support what is shaping up as a major regional campaign to convince state legislators that the governor’s “bold†new plan to throw out revenue sharing in favor of giving towns new taxing authority is a bad idea.

Besides Bridgton officials, among the audience of around 35 people attending the Jan. 20 forum were either selectmen or town managers from Waterford, Hiram, Oxford, Norway, Harrison, Naples, Bridgton, Denmark and Brownfield. It was equally gratifying for Bridgton Selectmen to see two current and one former legislator in attendance — Phyllis Ginzler, House District 69, of Bridgton; Nate Wadsworth, House District 70, of Hiram; and former House District 98 Legislator Rick Sykes, of Harrison.

They first heard an overview of the many elements of Gov. Paul LePage’s proposed fiscal year 2016–2017 biennial budget from Geoff Herman, legislative analyst for the Maine Municipal Association. The $6.3 billion, two-year plan presented Jan. 9, would cut income taxes and increase and broaden the sales tax.

LePage has said his budget would better balance the three major sources of tax revenue (state sales tax, state income tax and local property taxes) by increasing state sales taxes from 24 to 32% and decreasing income taxes from 32 to 20%.

The dilemma, as the towns see it, is that LePage’s budget would increase local property taxes from 45 to 48% of the total of the three taxes, which would “wreak havoc†on municipal budgets having to make up the difference. That’s because, in order to accomplish his aim of comprehensive tax reform, LePage is proposing to maintain revenue sharing funding at last year’s reduced level, which amounts to $60 million, or 40% of the $165 million required by law. Worse still, from a municipal perspective, LePage is proposing to eliminate revenue sharing altogether after July 2016.

To soften the blow, LePage is proposing to give towns new taxing authority from several sources. Towns would be able to tax 50% of the value of currently tax-exempt institutions exceeding $500,000 in value, excluding churches and government property, and also collect taxes on the personal property of two-way, interactive telecommunications facilities, such as that bolted onto cell phone towers. The Homestead Exemption for persons under age 65 would also be eliminated, which would hurt under-65 taxpayers but increase revenue for municipal budgets.

“I don’t think I’ve ever seen a budget that’s as comprehensive†as the current proposal, Herman said.

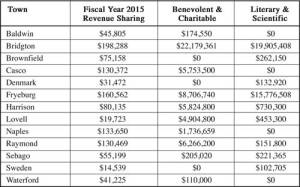

Bridgton Selectman Paul Hoyt said he’d like to see a town-by-town breakdown that would show how much revenue towns would get under LePage’s proposed changes when compared to the current funding from revenue sharing. Herman did say that the MMA has calculated that only 60 of the 500 towns in the state with hospitals and/or major colleges and other high-value tax-exempt properties would obtain enough tax revenue under the governor’s plan to overcome their lost municipal revenue sharing. “And no one would get full revenue sharing back,†he said.

Strategizing

With marker in hand, Bridgton Town Manager Bob Peabody wrote down some ways in which the towns might be most effective in convincing legislators not to tamper with the revenue sharing program, a time-honored cost-sharing arrangement that has served as the major source of local revenue for towns for 41 years.

Most in attendance agreed that, as the 127th Legislature rolls up its sleeves in the coming months to debate LePage’s tax reform ideas, the most important thing towns and taxpayers can do is to lobby state lawmakers, in order to keep the revenue sharing program intact.

“It’s up to everybody here to decide exactly what to do about it,†Herman told the gathering. The MMA’s Legislative Policy Committee will shape its strategy in large part to conform to what the towns tell them to do. He passed out copies of a booklet on the many state-municipal partnership programs over the years, to point out the many ways the state has backed away from its promises to reimburse towns for performing functions for the state. When it comes to state mandates dealing with animal control, sand/salt sheds, cemetery maintenance, junkyards and many other services, legislative support in terms of reimbursement has eroded greatly over time.

“Are we working together, or is it just an unfunded state mandate?†Herman asked.

Most agreed that it would be ineffective to repeat last year’s protest against revenue sharing cuts, when town officials from all over the state went to Augusta to testify at an all-day hearing. A more collaborative strategy is preferred this year, so that the towns can speak with one voice.

While most were against any policy that would eliminate revenue sharing, some of those attending believed any action plan ought to also demand that the state honor its mandate to pay for 55% of education costs. School spending now comprises up to 70% of the amount raised by taxes, in Harrison and many other property-rich towns.

Bridgton Selectman Ken Murphy asked the legislators in attendance to weigh in on the discussion. Ginzler started out by saying she expects there’ll be many compromises in the budget package before passage, but added that, “The purpose of the budget is to spur economic growth†and LePage’s “bold†plan aims to do just that.

An inhibitor to having businesses relocate to Maine has been the personal income tax, she said, and under the LePage budget that tax goes down from 32 to 20%. Opinions notwithstanding, she added, “I am glad that these issues are out on the table†with the hope that real tax reform will follow.

Hoyt was in favor of a less compromising approach, pointing out the modest success from last year’s fight by towns against further cuts to revenue sharing.

“How about saying no and just don’t do it?†Hoyt said. It is the “wrong mentality†for towns to allow state lawmakers to further erode an already severely underfunded program, he said.

“We need to get a large enough group together to speak with a large enough voice to just say no,†said Hoyt. Mention was made of the need to get State Sen. Jim Hamper involved. The Oxford Republican represents District 19, which covers most of the towns that attended, and is chairman of the Appropriation and Financial Affairs Committee that deals with budget methodologies.

There was mention of the need for follow-up meetings, but no specific dates were set. Peabody promised to prepare a summary and distribute it to those attending.